Overview

The Office of Integrity, Compliance and Accountability (ICA) is an operationally independent office. In this context, independence means that ICA is functionally independent of the other units, divisions, departments and offices of the Bank. ICA reports administratively to the President and functionally to the Board of Directors through its Oversight and Assurance Committee.

By the numbers

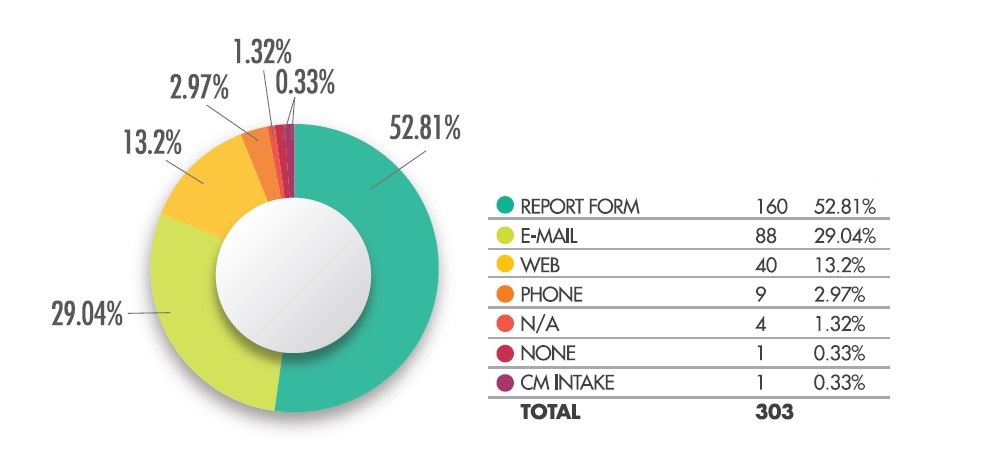

Intake Sources for All Registered Matters in ICA's Case Management System from 2017 to 2023

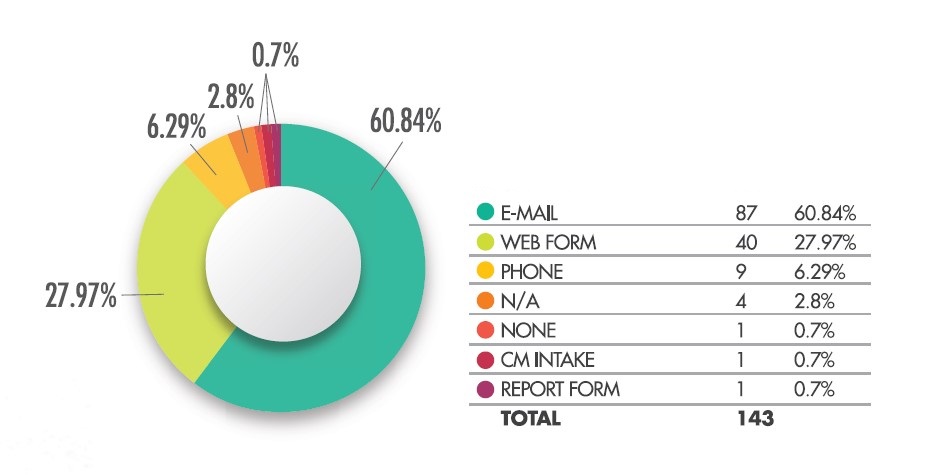

Intake Sources for All Investigations in ICA's Case Management System from 2017 to 2023

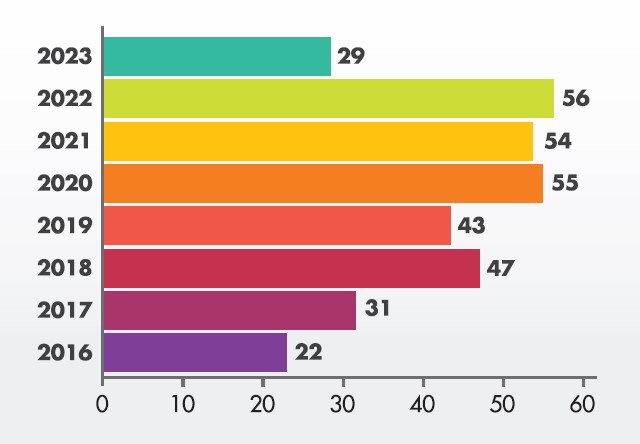

Investigative Activities including EDD from 2016 to 2023

Functions of ICA

Institutional Integrity

Reinforcing a culture that promotes institutional integrity within CDB and prohibits wrongdoing related to fraud, corruption, collusion, coercion and other corrosive practices.

Ethics

Reinforcing a culture that promotes ethics within the Bank and ensuring adherence to any Code of Conduct, or rules and regulations issued by the Bank for its Directors and Staff.

Accountability

Receiving, responding to and resolving citizen-driven complaints of environmental and social harm allegedly caused by projects CDB finances.

Compliance

Overseeing CDB’s compliance with standards, policies and procedures for anti-money laundering/countering the financing of terrorism, monitoring of financial sanctions and other compliance-related risks.

Whistleblowing

Providing a Whistleblower System through which a whistleblower can make a complaint, submission, report or disclosure.

Whistleblowing and Reporting

A Whistleblower System, which provides the primary mechanisms for the secure receipt and handling of all complaints, submissions, reports and disclosures from persons classified as whistleblowers and witnesses, as provided for in the Whistleblower Policy.

ENHANCED DUE DILIGENCE FORM FOR PRIVATE SECTOR OPERATIONS

A comprehensive form which allows for the identification, assessment and mitigation of potential institutional integrity, compliance and reputational risks in CDB’s private sector operations.

SANCTIONS

CDB sanctions firms and individuals who have engaged in fraud, corruption, collusion, coercion, interference with investigations/obstructive practices and other similar wrongdoing, in violation of CDB’s policies, procedures, and guidelines.